Not known Facts About Hiring Accountants

Not known Facts About Hiring Accountants

Blog Article

Indicators on Hiring Accountants You Need To Know

Table of ContentsHiring Accountants Things To Know Before You BuyThings about Hiring AccountantsThe 20-Second Trick For Hiring AccountantsHiring Accountants Fundamentals ExplainedThe Single Strategy To Use For Hiring Accountants

Is it time to hire an accounting professional? From simplifying your tax obligation returns to analyzing financial resources for boosted success, an accounting professional can make a big distinction for your organization.An accountant, such as a qualified public accounting professional (CERTIFIED PUBLIC ACCOUNTANT), has actually specialized understanding in financial administration and tax compliance. They stay up to day with ever-changing laws and finest techniques, making sure that your company stays in conformity with legal and regulative needs. Their expertise enables them to navigate complicated financial issues and provide precise reputable advice customized to your certain business requirements.

For those that do not currently have an accounting professional, it might be tough to understand when to reach out to one. Every company is different, but if you are dealing with obstacles in the complying with areas, currently may be the right time to bring an accounting professional on board: You don't have to compose a service strategy alone.

Little Known Questions About Hiring Accountants.

The stakes are high, and a professional accounting professional can assist you obtain tax obligation guidance and be prepared. We recommend chatting to an accounting professional or other money professional regarding a number of tax-related objectives, consisting of: Tax obligation planning methods.

By collaborating with an accounting professional, businesses can strengthen their loan applications by giving more exact financial info and making a far better situation for monetary stability. Accountants can also assist with jobs such as preparing economic records, assessing financial data to evaluate credit reliability, and creating a thorough, well-structured lending proposition. When points change in your service, you desire to make certain you have a strong handle on your funds.

Are you ready to offer your business? Accounting professionals can help you establish your service's worth to help you safeguard a fair deal.

Hiring Accountants - Truths

Individuals are not called for by regulation to visit homepage keep monetary publications and records (businesses are), yet refraining this can be a costly blunder from a monetary and tax point of view. Your checking account and credit report card statements might be incorrect and you might not find this till it's too late to make modifications.

Whether you need an accounting professional will certainly most likely depend upon a few variables, including how complicated your advice tax obligations are to file and the number of accounts you need to manage. This is a person who has training (and likely an university degree) in accountancy and can deal with accounting jobs. The hourly rate, which again depends on place, work summary, and expertise, for a freelance accounting professional is regarding $35 per hour on typical yet can be significantly more, align to $125 per hour.

The Of Hiring Accountants

While a CPA can give bookkeeping solutions, this specialist may be also costly for the job. Per hour charges for CPAs can run around $38 per hour to begin and enhance from there. (Many Certified public accountants don't deal with bookkeeping services personally however use an employee in their company (e.g., a bookkeeper) for this job.) For the jobs explained at the beginning, a personal accountant is what you'll require.

It syncs with your checking account to simplify your individual financial resources. Both Quicken and have mobile apps to videotape details on the fly. You can deal with read more an accountant to aid you begin with your individual bookkeeping. Search for someone knowledgeable in the software application you prepare to use. The bookkeeper can establish accounts (which operate like folders) that you put your info in.

The bookkeeper can additionally examine your job regularly (e.g., quarterly) to see to it you're videotaping your earnings and expenses appropriately and integrating your bank declaration properly. You choose to handle your individual accounting, be certain to divide this from accountancy for any company you possess. Build the price of this accounting into your family budget plan.

Things about Hiring Accountants

As tax season techniques, individuals and businesses are faced with the seasonal inquiry: Should I tackle my taxes alone or employ an expert accounting professional? While the allure of conserving money by doing it on your own may be alluring, there are compelling reasons to think about the know-how of a qualified accountant. Below are the top factors why working with an accountant may be a wise investment contrasted to browsing the complex globe of taxes on your very own.

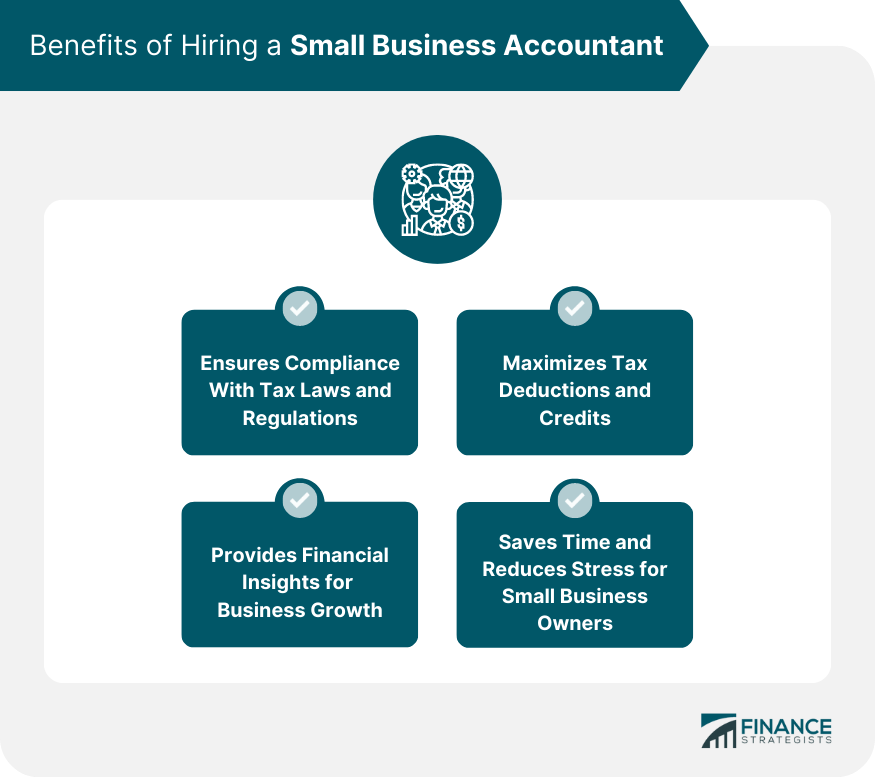

Tax obligations are complicated and ever-changing, and a skilled accounting professional stays abreast of these modifications. Their proficiency guarantees that you capitalize on all offered deductions and credit ratings, inevitably optimizing your possible tax obligation cost savings. Finishing your own tax obligations can be a lengthy and labor-intensive process. Working with an accounting professional releases up your time, enabling you to concentrate on your individual or service activities.

Report this page